What is SBITA? How to Know if Your Organization Has Them

May 25, 2023 •HoganTaylor

GASB Statement No. 96

What is GASB 96?

Because of the increased popularity of subscription-based information technology arrangements (SBITAs) the GASB issued Statement No. 96 (GASB 96). This statement provides guidance on the accounting and financial reporting for SBITAs.

Who does GASB 96 apply to?

GASB 96 applies to all state and local governmental entities, including public benefit corporations and authorities, public employee retirement systems, and governmental utilities, hospitals, colleges, and universities that are currently using subscription-based applications.

What is the effective date?

The requirements of GASB 96 are effective for fiscal years beginning after June 15, 2022. Therefore, entities with a June 30, 2022 year-end have an effective date for GASB 96 of July 1, 2022. The effects of the standard must be presented on the June 30, 2023, financial statements. Early application is encouraged.

Why was GASB 96 issued?

The mission of the GASB is to establish and improve accounting and reporting standards to provide useful information to users of financial reports. GASB 96 will improve financial reporting by formally defining SBITAs and providing uniform guidance for accounting and financial reporting. It will increase the reliability and transparency of government financials by requiring GASB entities to report a subscription asset and subscription liability for SBITAs and disclose important information about these arrangements. These disclosures will help users of the financial statements better evaluate the entity’s obligations related to SBITAs.

What is a SBITA?

GASB 96 defines a SBITA as “a contract that conveys control of the right to use another party’s information technology software, alone or in combination with tangible capital assets, as specified in the contract for a period of time in an exchange or exchange-like transaction.”

If you are familiar with GASB Statement No. 87 Leases (GASB 87) this definition may seem familiar. However, some nuances exist specific to software subscriptions. Below are some additional considerations for determining if a contract is a SBITA.

Right to use

To determine whether a contract conveys control of the right to use the underlying IT assets, a government should assess whether it has both of the following:

- The right to obtain the present service capacity from use of the underlying IT assets as specified in the contract.

- The right to determine the nature and manner of use of the underlying IT assets as specified in the contract.

Determining if a contract conveys the right to obtain the present service capacity of the underlying asset involves analyzing whether your organization has the right to benefit from the use of the software for which it is paying. This could be through the direct use of the software, the ability to exchange the present service capacity for another asset, such as cash, or employ the asset in any of the other ways it may provide benefit to your organization.

Sometimes determining whether an organization has the right to decide the nature and manner of use of the underlying application can be complex. Examine the issue by analyzing if your organization has the right to say how, when, and where the underlying IT assets are used, despite the SBITA vendor owning the IT assets. If you can assign users to complete tasks for the organization using the software during the terms of the contract, your organization is directing the use of the software.

Period of time

Does the contract specify a start date and an end date?

When analyzing a contract to determine whether or not it is within scope of GASB 96, ask yourself, “When the contract term ends, will I lose the ability to use the software?” If the answer is yes, then you probably have a SBITA under GASB 96.

Exchange or exchange-like transactions

An exchange or exchange-like transaction is one in which each party receives and sacrifices something of approximately equal value. A non-exchange transaction is one in which one party receives something of value without directly giving value in exchange. For example, if an organization pays one dollar per year to use an ERP system for 10 years, the agreement is most likely a non-exchange transaction and would not meet the definition of a SBITA.

To simplify the specifics related to the definition, an organization can ask themselves these questions to determine whether or not they have SBITA:

- Have you entered into an agreement with a provider to use their software or technology?

- Are you able to benefit from the use of the software or technology?

- Are you paying the market rate or the equivalent to what the right to use the software or technology is worth?

- Is there a specified start and end date? Will you lose access to the software or technology at the end of the contract?

If you can answer yes to all of these questions, your subscription is likely a SBITA.

What is out of scope?

The guidance specifically outlines certain agreements for which GASB 96 does not apply, such as contracts meeting the definition of arrangements covered in other statements and certain IT arrangements like perpetual licensing agreements. When a contract meets the criteria for these other types of agreements, it is considered to be out of scope for GASB 96 and treated according to the guidance of the appropriate GASB statement.

Agreements for both the right to use software and tangible capital assets and for which the software component is insignificant as compared to the cost of the capital assets are accounted for under GASB. 87, if they meet the definition of a lease. If an agreement is for the right to use both software and IT hardware the accounting treatment is dictated by the more significant right-of-use asset.

For example, imagine a hardware company leases a server to an entity at an annual cost of $100,000. In addition, a software component is required to operate the server at an annual cost of $1,000. This arrangement would be out of scope for GASB 96 because the software component is insignificant when compared to the capital asset costs.

GASB 96 only covers contracts where a vendor is providing the government entity the right to use the vendor’s underlying IT assets, not contracts where the government entity is the vendor to another party. Agreements in which government entities provide other entities the right to use IT software through SBITAs are not within the scope of GASB 96.

For instance, if “Government A” created a software to help other entities research grants available for government programs and then offer other government entities the ability to use the software through SBITA arrangements, those arrangements are not under the scope of GASB 96.

Contracts that meet the definition of a public-private and public-public partnerships fall under the scope of GASB Statement No. 94,Public-Private and Public-Public Partnerships and Availability Payment Arrangements. These are arrangements in which a government contracts with an operator to provide public services by allowing the operator the right to use a nonfinancial asset of the government.

Finally, agreements providing a perpetual license to use a vendor’s software are also not in the scope of GASB 96. This is because a perpetual license to use software has no end-date and therefore does not meet the period of time criteria for a SBITA. These types of arrangements are accounted for under GASB Statement No. 51Accounting and Financial Reporting for Intangible Assets.

Determining if you have a SBITA

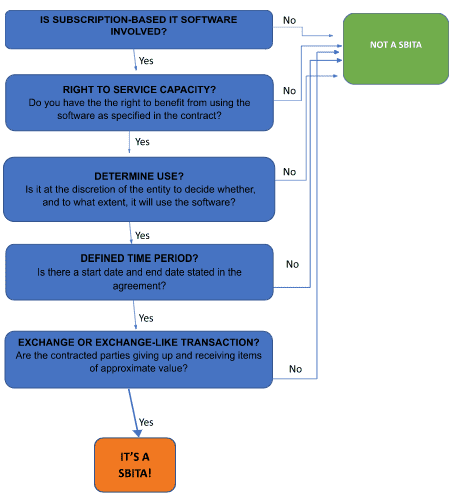

Because of the number of arrangements that do not fall under the guidance of GASB 96 and the various criteria required to meet the definition of SBITA, deciding to account for a contract under GASB 96 can be a complicated process. To take some of the complexity out of these determinations we have put together a decision tree for identifying a SBITA.

First, determine what type of contract is being analyzed and whether the underlying asset is within the scope GASB 96. If the agreement is for a subscription to an IT software or application, GASB 96 may be applied. By first determining whether the contract is in scope, you save time by not needing to analyze the other GASB 96 criteria in out-of-scope contracts.

Once you determine your contract is within the scope of GASB 96, you can proceed to analyze the terms of the contract for the criteria necessary for a SBITA. The following decision tree helps identify whether or not you have a SBITA:

Now that you’ve identified SBITAs at your organization, it is time to recognize a subscription asset and subscription liability for each contract. To find out more about the accounting treatment, check out the article below.

GASB 96 (SBITA) Explained: Definition, Calculation, Example, & More

Summary

Implementing GASB 96 may seem like an overwhelming project, but the accounting treatment mirrors that under GASB 87. If your organization transitioned to GASB 87, this should be a familiar process. The Ultimate GASB 96 Guide provides important insights on the adoption process.

How HoganTaylor Can Help

HoganTaylor Lease Accounting Thought Leadership is designed to help you keep up with the latest lease accounting issues that can affect your organization and its compliance. If you have any questions about the content of this publication, or if you would like more information about partnering with HoganTaylor Lease Accounting, please contact one of our experts.

INFORMATIONAL PURPOSE ONLY. This content is for informational purposes only. This content does not constitute professional advice and should not be relied upon by you or any third party, including to operate or promote your business, secure financing or capital in any form, obtain any regulatory or governmental approvals, or otherwise be used in connection with procuring services or other benefits from any entity. Before making any decision or taking any action, you should consult with professional advisors.

Get Updates

Featured Articles

Categories

- Advisory Publications (6)

- Business Valuation (9)

- Employee Benefit Plans Publications (25)

- Energy Publications (6)

- Estate Planning Publications (34)

- Forensic, Valuation & Litigation Publications (20)

- HoganTaylor Insights (8)

- HoganTaylor Talent (49)

- Lease Accounting Publications (14)

- Litigation Support (1)

- Nonprofit Publications (59)

- Tax Publications (55)

- Technology Publications (6)

- Wealth Management (1)