November 11, 2021 •Denise Felber, CPA, Tax Partner

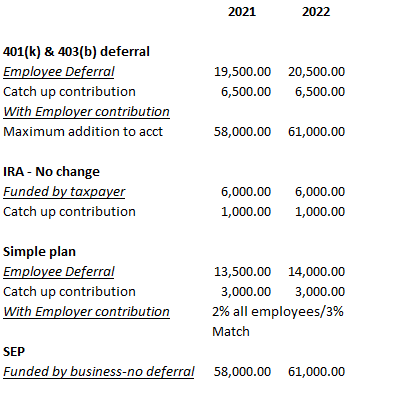

Retirement contributions are a great way to generate deductions, save taxes and keep the money! The IRS has issued a notice with the new limits for 2022. As you budget for 2022 or complete your employer enrollment forms, keep in mind the new limits.

Each plan has different enrollment dates and funding dates. Review the rules or discuss with your accountant before December 31. Keeping your money and getting a deduction is a win for the taxpayer.

Our team of experts at HoganTaylor Wealth assists clients with maximizing their contributions to be tax efficient with a long-term investment mindset. To speak with one of our Wealth advisors, please see below.

If you have any questions about the content of this publication, or if you would like more information about HoganTaylor's Tax practice, please email Tony Otto, Tax Practice Lead, at jotto@hogantaylor.com. You may also contact Denise Felber, Tax Partner, at dfelber@hogantaylor.com

INFORMATIONAL PURPOSE ONLY. This content is for informational purposes only. This content does not constitute professional advice and should not be relied upon by you or any third party, including to operate or promote your business, secure financing or capital in any form, obtain any regulatory or governmental approvals, or otherwise be used in connection with procuring services or other benefits from any entity. Before making any decision or taking any action, you should consult with professional advisors.