ASU 2016-02: What to Know about the New Lease Standard

August 27, 2018 •Shawn Richardson, CPA, Assurance Partner

The objective of the new lease standard, ASU 2016-02, is to increase transparency and comparability among organizations by recognizing lease assets and lease liabilities on the balance sheet and disclosing key information about leasing arrangements. This standard is effective for nonprofits classified as public entities for fiscal years beginning after December 15, 2018, and all other nonprofit entities for fiscal years beginning after December 15, 2019.

What’s Different Under the New Standard?

The main difference between current generally accepted accounting principles (GAAP) and the new standard is the recognition of lease assets and lease liabilities by lessees for those leases classified as operating leases under current GAAP. For leases with a term of 12 months or less, a lease is permitted to make an accounting policy election by class of underlying asset not to recognize lease assets and lease liabilities. If a lease makes this election, it should recognize lease expense for such leases generally on a straight-line basis over the lease term.

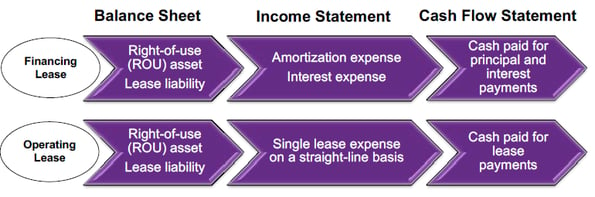

There continues to be a differentiation between finance leases and operating leases and the related presentation of expenses and cash flows. The table below outlines the differences for the income statement and cash flow presentation of finance and operating leases:

Mechanick, J. and Cole, R. (2018). GAAP Update. Presentation, AICPA Not-for-Profit Industry Conference

In transition, lessees and lessors are required to recognize and measure leases at the beginning of the earliest period presented using a modified retrospective approach. The modified retrospective approach includes a number of optional practical expedients that entities may elect to apply. These practical expedients relate to the identification and classification of leases that commenced before the effective date, initial direct costs for leases that commenced before the effective date, and the ability to use hindsight in evaluating lessee options to extend or terminate a lease or to purchase the underlying asset.

An entity that elects to apply the practical expedients will, in effect, continue to account for leases that commence before the effective date in accordance with previous GAAP unless the lease is modified. The exception is that lessees will be required to recognize a right-of-use asset and a lease liability for all operating leases at each reporting date based on the present value of the remaining minimum rental payments that were tracked and disclosed under previous GAAP.

How to Prepare for the New Standard

In anticipation of adopting ASU 2016-02, not-for-profit entities should consider different aspect of leases and the effect the adoption will have on different components of operations. Such aspects include:

- What leases are out there and do you have an inventory of all leases to be able to analyze between operating and finance leases?

- Are the leases considered material in relation to the financial statements taken as a whole?

- Have you discussed the effects of the standard with your financial institutions related to debt covenants?

Nonprofit entities should begin the discussions around the new lease standard in the near term. Although still not effective for the current year financial statements, adoption of the standard will take significant time to address. We also encourage accessing the FASB.org web page and digest as much information as you can to understand the impact to your organization.

HoganTaylor’s Nonprofit Practice

The HoganTaylor Nonprofit practice can help you navigate the implications of the new lease standard. If you have any questions about the content of this article, or how ASU 2016-02 might impact your nonprofit, please contact the author, Shawn Richardson, at srichardson@hogantaylor.com or the Nonprofit Practice Lead, Jack Murray, at jmurray@hogantaylor.com.

INFORMATIONAL PURPOSE ONLY. This content is for informational purposes only. This content does not constitute professional advice and should not be relied upon by you or any third party, including to operate or promote your business, secure financing or capital in any form, obtain any regulatory or governmental approvals, or otherwise be used in connection with procuring services or other benefits from any entity. Before making any decision or taking any action, you should consult with professional advisors.

Get Updates

Featured Articles

Categories

- Advisory Publications (5)

- Business Valuation (9)

- Employee Benefit Plans Publications (30)

- Energy Publications (9)

- Estate Planning Publications (42)

- Forensic, Valuation & Litigation Publications (23)

- HoganTaylor Insights (8)

- HoganTaylor Talent (56)

- Lease Accounting Publications (15)

- Litigation Support (1)

- Nonprofit Publications (80)

- Tax Publications (101)

- Technology Publications (10)

- Wealth Management (2)