Stay Reasonable, Even in Turmoil

March 17, 2020 •Matt Bacon, HoganTaylor Wealth Manager

I know the last couple of weeks have been extremely tough on everyone. These can be scary times, a fact I am keenly aware of because my 13-year-old daughter, who is constantly watching the news, is getting scared. I know what you are thinking… “your 13-year-old is watching and listening to the news?!” Yes, she’s an NPR news junkie like her father!

I always tell her the news is there to inform you, but you have to be careful not to let it drive your emotions and decision making. This is good advice for investors too, though most don’t take heed, choosing instead to follow their emotions, a normal response.

With the market setting new highs at the beginning of the year, stocks prices have fallen dramatically as more news and information is brought to bear regarding the spread of coronavirus in China, Europe, and the rest of the world.

This is why a reasonable long-term investment strategy that keeps you from burying your head in the sand is so important. In such a strategy, you reflect, consider, and prudently decide where to take investment risk with your capital based upon your goals and objectives.

There are many risks besides market volatility. If you haven’t set a reasonable long-term investment strategy, or if you’re concerned you might not have set a prudent long-term strategy in the past, we’re happy to visit with you.

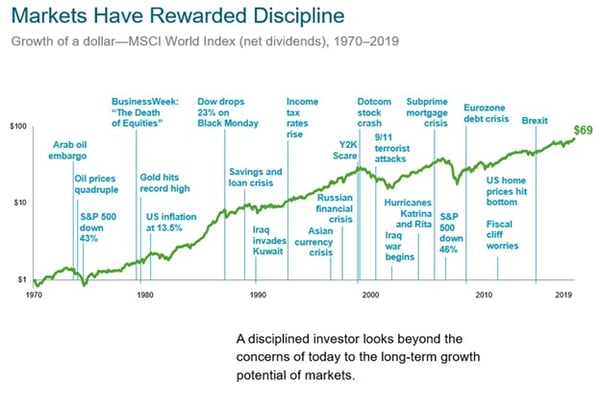

In US dollars. MSCI data © MSCI 2020, all rights reserved. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is no guarantee of future results.

Like the headlines surrounding the SARS, H1N1, and Ebola outbreaks of the past, the COVID-19 headlines are scary, but it’s important not to make long-term, financial decisions based upon these short-term events.

We know this can be hard.

One thing I have seen firsthand is how investors react to the market movements. Most investors only feel comfortable buying investments that have already increased in price. This is why the average stock investor has underperformed the market. Some studies suggest the average investor achieved a 4.5% annualized return vs. 9% market annualized return.

It is hard to separate our emotions from investment decisions, but investors that remain disciplined have been rewarded.

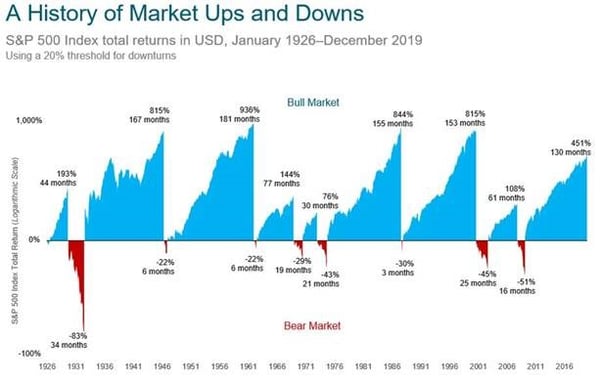

Chart end date is 12/31/2019, the last trough to peak return of 451% represents the return through December 2019.

Bear markets are defined as downturns of 20% of greater from new index highs. Bull markets are subsequent rises following the bear market trough through the next new market high. The chart shows bear markets and bull markets, the number of months they lasted and the associated cumulative performance for each market period. Results for different time periods could differ from the results shown.

Past performance is no guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

Source: S&P data © 2020 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved

It may seem that investors and stock prices are behaving irrationally. This happens sometimes. Prices of investments change throughout the day based upon the most recent and up to date information about a company’s prospects for future earnings and perceived risk.

None of this information tells the future.

So, with all that in mind, you might be asking “Why not take some money out of stocks before I lose even more, then get back in at a lower price?”

We only know that stocks have gone down in the short-term and, try as we might, there just isn’t a clear indicator of how long stocks will continue down and when they might rise back up.

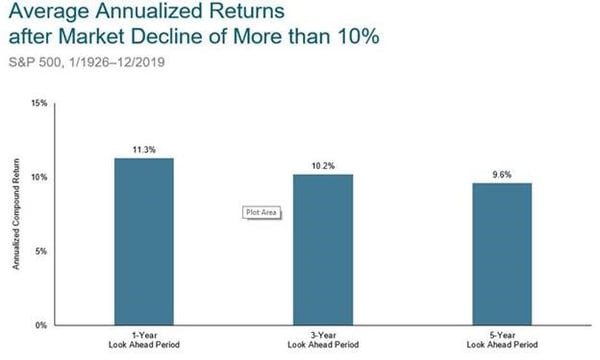

The honest truth is that the expected return is more likely to be higher in the future. The odds of this are very much in favor of this happening.

Since 1926, the S&P 500 returned about +10% in future one-, three-, and five-year periods after a decrease of at least 10%. This is the same annual return over all the one-, three-, and five-year periods. So, there’s a chance, if you sell what’s already dropped, by the time you get back in prices might be higher, and you might lose out on any potential recovery.

Chart end date is 12/31/2019, the last trough to peak return of 451% represents the return through December 2019.

Bear markets are defined as downturns of 20% of greater from new index highs. Bull markets are subsequent rises following the bear market trough through the next new market high. The chart shows bear markets and bull markets, the number of months they lasted and the associated cumulative performance for each market period. Results for different time periods could differ from the results shown.

Past performance is no guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

Source: S&P data © 2020 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved

Disciplined InvestmentsDisciplined Investments L.L.C., d/b/a HoganTaylor Wealth (HT Wealth) provides an integrated approach to investment and financial planning. HT Wealth is a registered investment advisor and subsidiary of HoganTaylor LLP. Working with our clients’ other advisors, we are able to help coordinate the investment, tax, estate, and insurance protection issues to simplify the needs of individuals, families and business owners. If you have any questions about the content of this publication, or if you would like to visit with a HT Wealth wealth manager regarding your long-term investment strategy, please contact the author, Matt Bacon, via email at mbacon@ht-di.com or by phone at 918.388.2690. INFORMATIONAL PURPOSE ONLY. This content is for informational purposes only. All expressions of opinion are subject to change. This content does not constitute professional advice and should not be relied upon by you or any third party. This content is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. Past performance is not a guarantee of future results. There is no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal. Investors should talk to their financial advisor prior to making any investment decision. Investors should talk to their financial advisor prior to making any investment decision. Disciplined Investments L.L.C., d/b/a HoganTaylor Wealth, a registered investment advisor and subsidiary of HoganTaylor LLP. |

Get Updates

Featured Articles

Categories

- Assurance (3)

- Business Advisory Thought Leadership for COVID-19 (39)

- Consolidated Appropriations Act, 2021 (3)

- Coronavirus Aid, Relief and Economic Stimulus (33)

- COVID-19 (58)

- Families First Coronavirus Response Act (2)

- Human Capital Thought Leadership for COVID-19 (3)

- Main Street Lending Program Thought Leadership (4)

- Messages From The CEO (1)

- Nonprofit Thought Leadership for COVID-19 (6)

- Paycheck Protection Program (PPP) Loan Thought Lea (31)

- Tax Thought Leadership for COVID-19 (10)

- Technology Thought Leadership for COVID-19 (1)

- Tools to Help You Overcome COVID-19 Challenges (3)

- Wealth Management Thought Leadership for COVID-19 (2)

- Webinars to Help You Overcome COVID-19 Challenges (10)