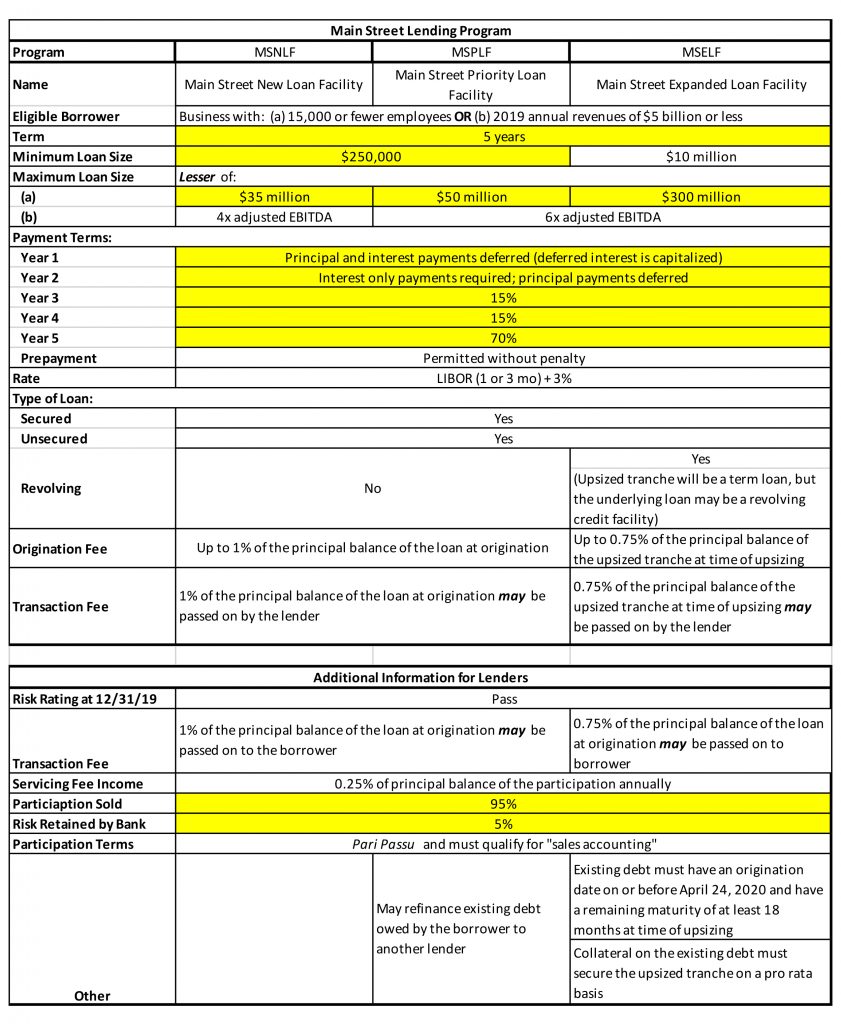

On June 8, the Federal Reserve further expanded the Main Street Lending Program (MSLP) and clarified requirements and key terms of the program. The most recent modifications will allow more small and medium-sized businesses to qualify to participate in the program and increase the flexibility in the loan repayment terms. The key revisions to the term sheets include:

Main Street New Loan Facility

-

- Reduced the minimum loan size to $250,000

- Increased the maximum loan size to $35 million

- Increased the loan term to 5 years

- Extended the repayment period by delaying principal for a period of two years, with interest-only payments required in year two, 15% paydown in years three and four, and 70% paydown in year five

Main Street Priority Loan Facility

-

- Reduced the minimum loan size to $250,000

- Increased the maximum loan size to $50 million

- Increased the loan term to 5 years

- Extended the repayment period by delaying principal for a period of two years, with interest-only payments required in year two, 15% paydown in years three and four, and 70% paydown in year five

- Raised the portion of the loan to be purchased by the MSLP Special Purpose Vehicle to 95% reducing the eligible lender’s risk exposure

Main Street Expanded Loan Facility

-

- Increased the maximum loan size to $300 million

- Removed the requirement that the expanded loan not be more than 35 percent of the borrower’s existing outstanding and undrawn debt

- Increased the loan term to 5 years

- Extended the repayment period by delaying principal for a period of two years, with interest-only payments required in year two, 15% paydown in years three and four, and 70% paydown in year five

The Federal Reserve began accepting lender registrations on June 15, 2020 and has encouraged lenders to begin originating MSLP loans as soon as they are registered for the program. Eligible borrowers should contact their financial institution for additional information on the application process. The Department of Treasury released initial term sheets for the Nonprofit Organization New Loan Facility and Nonprofit Organization Expanded Loan Facility. The comment period on the initial term sheets expired on June 22, 2020 and new term sheets are expected to be provide by the Department of Treasury.

HoganTaylor's Advisory PracticeIf you have any questions about this content, or if you would like more information about HoganTaylor's Advisory practice, please contact Robert Wagner, Advisory Partner, at rwagner@hogantaylor.com. More information is also available on the Advisory practice page of this website. INFORMATIONAL PURPOSE ONLY. This content is for informational purposes only. This content does not constitute professional advice and should not be relied upon by you or any third party, including to operate or promote your business, secure financing or capital in any form, obtain any regulatory or governmental approvals, or otherwise be used in connection with procuring services or other benefits from any entity. Before making any decision or taking any action, you should consult with professional advisors. |