Employee Retention Credit (ERC)

January 19, 2021 •Denise Felber, CPA, Tax Partner

For more information eligibility for the Employee Retention Tax Credit (ERTC) or a refund of the credit on your prior payroll taxes, read Further Detail Regarding Government Shutdown & Revenue Decreases

For more information eligibility for the Employee Retention Tax Credit (ERTC) or a refund of the credit on your prior payroll taxes, read Further Detail Regarding Government Shutdown & Revenue Decreases

Period of availability: March 12, 2020 thru July 1, 2021.

With two pieces of legislation, payroll tax credits are available to employers that meet certain criteria regarding business receipts, employee count, and wages.

Eligibility by Quarter Based Upon

Or a complete or partial suspension of operations due to an order by an appropriate governmental authority or Gross receipts[1] reduction in comparison to the same quarter in 2019:

2020-gross receipts for 2020 are less than 50% of 2019 [2]

2021-gross receipts for 2021 less than 80% of same in 2019.

2021 alternative-elect to use the prior quarter and the corresponding 2019 quarter.

(For example, a business experienced a 20% or greater drop in 4q20 compared to 4q19, the business can elect to qualify for the ERC for the 1q21. If the business experienced a 20% or greater drop in 1q21 compared to 1q19, the business also qualifies for the credit for 2q21.)

Qualified Wages Based Upon FTE [3] Employee Count

2020 - Average 2019 monthly FTE employee count

Greater than 100 = only wages paid to an employee while NOT performing services (off or on site)

Less than 100 employees = all wages are qualifying wages for the credit (no work limitation)

First two quarters of 2021

Threshold raised to 500 employees (no work limitation)

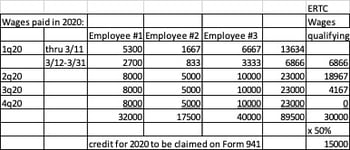

Credit Computation by Employee

2020-50% of $10,000 of qualified wages plus cost of health benefits

$5,000 max by employee for a year

2021-70% of quarterly qualified wages plus the cost of health benefits

$7,000 max by employee for each quarter

Qualified wages=Wages subject to FICA and Medicare (ignoring any increase from prior periods)

Limitation on Wages Used in Computation

Business with PPP loan and debt forgiveness

Wages used in the application for forgiveness can’t be used to compute credit

Wages in excess of the application amount can be used.

PPP loan #1 – 60% payroll and 40% rent/utilities

The forgiven amount will scale in proportion to the amount spent on payroll,

Up to total loan amount (see example)

Wages can be used for loan forgiveness, ERC or credit for paid sick leave due to Covid.

The taxpayer elects to apply wages to the loan or one of the credits.

Advance Payments for 2021 Credit

Based on 70% of average quarterly payroll for the same quarter in 2019 for 1q21 and 2q21

Reconciliation to actual required (additional credit or repayment)

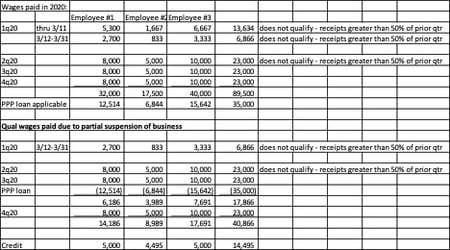

EXAMPLE 1:

Received PPP1 loan in 2020 - $35,000 (Forgiven in 2020)

Less than 100 employees.

Forgiveness application: Payroll costs of $50,000 (24-week period (April 1 through September 30))

Gross receipts for each quarter of 2019 - $67,000

Gross receipts for 2020 –- $65,000(1st), - $35,000 (2nd), $30,000 (3rd) and $30,000(4th)

A business qualifies for ERTC for 3q20 and 4q20 since gross receipts were less than 50% compared to same quarter in 2019. Amount of wages applicable to PPL loan are $35,000 (the lesser of wages-$50,000 or loan amount of $35,000). Excess is available to compute credit

EXAMPLE 2:

Same as Example 1 except loan forgiveness has not been requested yet and

Gross receipts for 2020 –- $25,000(1st), - $10,000 (2nd), $10,000 (3rd) and $25,000(4th)

A business qualifies for ERTC for all quarters since gross receipts were less than 50% compared to the same quarter in 2019. When applying for forgiveness on PPP1 loan, cannot use $30,000 of wages against forgiveness since taking ERTC credit for those wages since business elected to use for credit.

Claiming the Credit

The credit is claimed on Form 941 (Employer’s Quarterly Federal Tax Return). If credit is applicable to a quarterly Form 941 that has already been filed without the credit, then an amended 941 (941-X) can be filed. The excess of the credit over the employer’s portion of social security tax is refundable.

Information Request

2020 Payroll reports and employee payroll records by quarter.

March 12-March 31 payroll by employee

Health Insurance cost (employer plus employee cost)

2019 receipts by quarter

2019 FTE count by quarter

PP loan and status of forgiveness application

More Information

PP2 requirements – no more than 300 employees and had a decline in gross receipts during the 1st, 2nd, 3rd or 4th quarter of 2020 by 20% of more when compared to the same quarter in 2019.

Effective 1/1/21, state or local run colleges, universities, organizations providing medical or hospital care now qualify.

IRS Resource https://www.irs.gov/newsroom/faqs-employee-retention-credit-under-the-cares-act

[1] Gross receipts = sales less returns, revenue from services and investment income (IRC §448( c))

[2] After dropping below 50%, the credit is available until receipts exceed 80% in later quarter

[3] FTE based on 30 hour week or 130 per month

HOGANTAYLOR TAX SERVICES

In addition to general tax compliance and planning, HoganTaylor’s Tax professionals serve as business advisors to their clients. They offer expertise to assist individuals and organizations with planning, strategy, and a number of other senior management needs.

If you have any questions about the content of this publication, or if you would like to visit with a HoganTaylor Tax professional, please contact Tax Partner Denise Felber via email at dfelber@hogantaylor.com or by phone at 918.745.2333.

INFORMATIONAL PURPOSE ONLY. This content is for informational purposes only. This content does not constitute professional advice and should not be relied upon by you or any third party, including to operate or promote your business, secure financing or capital in any form, obtain any regulatory or governmental approvals, or otherwise be used in connection with procuring services or other benefits from any entity. Before making any decision or taking any action, you should consult with professional advisors.

Get Updates

Featured Articles

Categories

- Assurance (3)

- Business Advisory Thought Leadership for COVID-19 (39)

- Consolidated Appropriations Act, 2021 (3)

- Coronavirus Aid, Relief and Economic Stimulus (33)

- COVID-19 (58)

- Families First Coronavirus Response Act (2)

- Human Capital Thought Leadership for COVID-19 (3)

- Main Street Lending Program Thought Leadership (4)

- Messages From The CEO (1)

- Nonprofit Thought Leadership for COVID-19 (6)

- Paycheck Protection Program (PPP) Loan Thought Lea (31)

- Tax Thought Leadership for COVID-19 (10)

- Technology Thought Leadership for COVID-19 (1)

- Tools to Help You Overcome COVID-19 Challenges (3)

- Wealth Management Thought Leadership for COVID-19 (2)

- Webinars to Help You Overcome COVID-19 Challenges (10)